-

Posts

1,874 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by InternationalRockSuperstar

-

-

C'mon.... say you will eat your hat if it did.

I will eat my own cock.

-

There is a real chance the dollar will rally in the next year or so by 50%.

well zero is a real number, so yes I'll give you that.

-

Quite the opposite to gambling, my approach is conservative. I am hedging not gambling though I can see, by your hyper-inflationary logic, why you might think so. Personally, I do not think the dollar will hyper-inflate but devalue, by say 50%, and then only eventually.

it's already done more than that just in this decade so far...

-

All the signals are flashing red I know, but seems risky going all in on metals. I know some of you are and hats off to you for having golden balls. (How'd you explain that one to the missus?)

Having said that, I did order another 100oz of silver last week

you tell your missus you have gold?

I've buried mine where the divorce lawyers will never find it!

-

With all this funny money QE about, surely it is baked in the cake? It's just a matter of when it really becomes apparent to joe6pack...

correct.

they have already printed enough money to guarantee hyper-inflation and we are simply too far down the laffer curve for any tax rate increases to remove the money from circulation.

as you say, it's just a case of when is becomes apparent to J6P.

My money is on the 30s. Depression mark 2. Joe6pack won't be buying so many six packs and holding on to the little money he has.J6P will be watching helplessly from the sidelines as a handful of oligarchs buy up all the assets with freshly printed money.

-

It's possibly of theoretical interest, but the government wants exactly this: devalue the currency and at the same time make you pay for keeping up with inflation. Win-win for the government.

aye, seigniorage-gain and bracket-creep. theiving b******!

-

This is a catastrophe in the making. If rates go back up to 16%, where will the repossessions be at?

possibly not much higher. there's only so many repossessions they can enforce with 80,000 police.

-

What has been successful this year for you ?

sweet peas had a really good yield. will definately grow more of them in future. it's amazing how much better they taste than the ones from the shops. to be honest, I never actually realised that I liked pease 'till I grew them myself!

turns out spinach (although not really food

) has a good yield and is particulary useful if you want to grow a leafy salad type crop in an area which is too shady for lettuce.

) has a good yield and is particulary useful if you want to grow a leafy salad type crop in an area which is too shady for lettuce.I mentioned sweetcorn before. not a bad yield considering we don't really have the climate for it. haven't started harvest these yet.

carrots were good, although they grew in weird crooked shapes because the soil was too hard to grow straight down (I must have not dug over that bit well enough).

spuds are/were as reliable as ever.

my tomatoes are shite also

. this is the 2nd year running they've been shit. I won't bother with tomotoes next year.

. this is the 2nd year running they've been shit. I won't bother with tomotoes next year.I've got a few other things but those are the main crops.

am moving from West London to West Oxfordshire next month, so I will have LOTS more space next year.

-

http://www.telegraph.co.uk/finance/finance...-recession.html

Households take in lodgers to beat recessionFamilies are taking in an extra 500,000 lodgers amid the recession to help meet their mortgage costs.

...

Figures indicate numbers have risen to a total of almost one million in the past year as borrowers struggle to pay off their debts.

...

The most popular age to take in a lodger is 25 to 34 years old, with this age group making up a third of all new live in landlords

...

It is not an overstatement to say, that for many homeowners, the extra income from renting out a spare room to a lodger, could be the difference between keeping or losing their homes

...

-

25x Sweet corn (aiming for at least 50 heads of corn)

any luck?

all mine have either 2 or 3 cobs this year; I'd say about 2.75 on average.

-

oh dear...

http://www.timesonline.co.uk/tol/money/pro...icle6788443.ece

Banks force up mortgage deposits to 50%Lenders’ are supposedly lending more than ever, but the average loan relative to value is still high, preventing a market rally.

High-street banks are squeezing borrowers to such an extent that the average deposit on new loans can now be more than 50%, in the latest threat to the housing market recovery.

HSBC['s]...average loan relative to the value of the property fell to 49.9% in 2009

This means the average deposit — or equity — supplied was more than 50%, or £100,000 on the typical £200,000 property.

...

The figures come in a week when the banks claimed they were lending billions to households and businesses to kick-start the economy. However, the small print of their accounts reveals a £26 billion gap between the funds they say they lent out and the reality. While Barclays said it lent £8.5 billion to households in the first half, net new mortgage lending (after redemptions) was just £2.2 billion. The rest was lending through its Barclaycard arm.

Lloyds said it lent £18 billion to borrowers in the first half but the net figure was just £1 billion, while Royal Bank of Scotland boasted of £7.2 billion of lending when in fact the net figure was just £4.1 billion.

HSBC said the main reason for the drop in the amount it will lend was fewer applications from borrowers with small deposits, but Sunday Times readers with enough equity to get the best deals have complained of being turned away.

First-time buyers James Newbound and his girlfriend, Alex, of London, both 25, had a combined income of £95,000 and a deposit of £180,000 — or 45% for a property worth £400,000 — made up of savings and money from their families. They applied for a two-year fix from HSBC — which says it requires a 40% deposit — but were refused.

Adrian Bell, an Anglican clergyman from Fakenham, Norfolk, applied to HSBC for a mortgage with a 40% deposit on a three-bedroom home in Norwich, where he plans to retire, valued at £157,000. He was turned down by both HSBC and Abbey.

He said: “We were accepted on the Friday for a mortgage only to be told on the Monday that the offer had been withdrawn. No reason was given, even though we were classed as a customer . . . with a perfect financial track record.

“Having been with HSBC for over 25 years I was amazed that we were refused with a £62,000 deposit. It took almost a year to obtain our retirement home, which we could well have lost by the delay.”

The moves will worry thousands coming up to remortgage who think that, with decent equity, they will have access to the best deals. They are being urged to pay off as much of their debt as possible.

...

-

Yay!

http://www.telegraph.co.uk/finance/persona...-in-demand.html

Gold: Royal Mint doubles production of gold coins to meet surge in demandso that's why the price of lead's gone up!

-

Yep, Sovereigns and Britannia’s are CGT exempt. Any other gold isn’t.

anything the gov't doesn't know you have is exempt from tax.

-

I have a big decision to make very, very soon & really need to take my knowledge up a lot of levels.

loading up on fixed-rate debt to buy PMs?

switching from gold to silver or vice versa?

-

...

where the f*** have you been lately?

-

it's really not a good idea to store your wealth in a large, illiquid, highly visible, immobile asset when the state is going on the rampage.

http://www.express.co.uk/posts/view/114851...cing-a-tax-rise

1,000 HOMES A MONTH FACING A TAX RISEMORE than 1,000 homes a month are being secretly moved into higher council tax bands.

The “stealth revaluation” means owners who have improved their properties with extensions, garages and double-glazing face increases of more than £600 a year. Camera-wielding officials may decree that even laying a patio or landscaping the garden are enough move a home up a band.

...

most people simply cannot comprehend how worthless houses will be by the time the state has finished playing with the market.

-

Thanks

(The "New Topic" button is available to anyone

)

)hint taken.

http://www.greenenergyinvestors.com/index.php?showtopic=7180

-

What i think is unprecedented is the degree of global cooperation

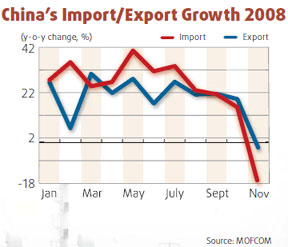

yeah - it's never fallen so much before:

-

Is that your writing or did you get it from somewhere else?

The reason I ask is that I collect great quotes, and have added that one, but wish to attribute it correctly

I like it very much.

the blue and red bit is Ayn Rand.

Rand has lot's of great quotes. here's another:

When you see that trading is done, not by consent, but by compulsion - when you see that in order to produce, you need to obtain permission from men who produce nothing - when you see that money is flowing to those who deal, not in goods, but in favors - when you see that men get richer by graft and by pull than by work, and your laws don't protect you against them, but protect them against you - when you see corruption being rewarded and honesty becoming a self-sacrifice - you may know that your society is doomed.edit: maybe you should start a quotes thread for one or two sentence quotes that manage to hit the nail on the head?

-

I can see what you're getting at, but I guess it all depends on what you consider to be enslavement and freedom.

enslavement would be having to work for nothing.

What one person receives without working for, another person must work for without receiving.

if central bankers do the red part; some other unfortunate individual(s) has to do the blue.

-

I was going to ask whether it would be a cause of enslavement

well, why would a small group of people ("central bankers") want to impose a currency on everyone else?

-

People tend to conveniently forget that gold standards have usually been in operation during periods of empires, with the militarily strong being in control at the expense of everyone else.

well of course the state has to be strong if it is able to impose a monetary standard (gold or otherwise) on an entire population.

Most of the world was effectively enslaved.bit like now then.

what else would you expect from a state-imposed currency?

-

let the free market sort out those banks who want to be the riskiest (without the central bank back stop)

agreed.

if other people want to d1ck about with FRB then that's fine by me - so long as they don't expect me to bail them out when it inevitably collapses.

-

Fractional reserve banking per se is not fraudulent.

it is.

no-one would deposit anything in a bank knowing that the receipt they received was going to be instantly devalued by fractional reserving unless the interest on the receipt made up for the devaluation - meaning there'd be no point.

fractionallly reserving deposits only works if the depositor doesn't understand the system.

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted