-

Posts

35,150 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by callmejoe

-

-

People know a bargain when they see one

-

China Increases Gold Holdings By 57% "In One Month" In First Official Update Since 2009China finally admitted that it had been misrepresenting its gold holdings for a very long time, when it announced that its gold holdings had increased from 38.89 million to 53.31 million troy ounces, a 57% increase "in one month."

..... why make the disclosure?

in revealing a surge in its gold holdings, the PBOC is hoping to finally.... get people buying stocks all over again.....

-

Silver Slammed As 'Someone' Dumps $1.4bn In 'Paper' Gold Futures http://www.zerohedge.com/news/2015-07-17/silver-slammed-someone-dumps-14bn-paper-gold-futures …

-

https://ghostgen.com/texas-announces-new-gold-back-bank/

TEXAS ANNOUNCES NEW GOLD-BACKED BANK...Governor Abbott issued the following statement:

“Today I signed HB 483 to provide a secure facility for the State of Texas, state agencies and Texas citizens to store gold bullion and other precious metals. With the passage of this bill, the Texas Bullion Depository will become the first state-level facility of its kind in the nation, increasing the security and stability of our gold reserves and keeping taxpayer funds from leaving Texas to pay for fees to store gold in facilities outside our state.”

-

ACK! #FUCKME! IM/ST data shows PBOC 2 'reset global gold price' 2 'stabilize SinoZone'! More in (next) ALTA rpt!

-

US Mint Runs Out Of Silver On Same Day Price Of Silver Plunges To 2015 Lows http://www.zerohedge.com/news/2015-07-07/us-mint-runs-out-silver-same-day-price-silver-plunges-2015-lows …

-

Ack! Did he say china has 9816 tons as of 2014! Chairman China Gold Association = http://www.lbma.org.uk/assets/events/BMF2015/Zhang%20Bingnan_EN1.pdf …

-

Citigroup just cornered the "precious metals ex gold" (i.e. silver) derivative market http://www.zerohedge.com/news/2015-07-04/why-did-citigroups-precious-metals-derivative-exposure-just-soar-1260 …

-

ACK! ACK AGAIN! Programming buddys from way-back are telling this is happening to their gold sales here in USA too!http://www.zerohedge.com/news/2015-07-03/gold-bullion-dealer-unexpectedly-suspends-operations-due-significant-transactional-d …

Gold Bullion Dealer Unexpectedly "Suspends Operations" Due To "Significant Transactional Delays" -

Jim Willie said Texas can expect to get whacked for demanding their gold back

Here's someone's comments on YT

The sudden attack on the Confederate flag and the burning of 6 predominantly Black Churches over the last two weeks, is perhaps the beginning of a backlash against Texas for their demands to have their gold returned. Black ops and sleepers they are the real terrorists.and today, just as he suggested: http://www.zerohedge.com/news/2015-07-02/train-carrying-toxic-gas-derails-tennessee-catches-fire-thousands-evacuated -

http://www.zerohedge.com/news/2015-07-01/fallout-ratio-flashing-red-chart-realtors-dont-want-you-see

"The Fallout Ratio" Is Flashing Red - The Chart That Realtors Don't Want You To See

-

-

Chinese Gold Standard Could Create 'Fireworks' - Bloomberg Intelligence

-

Tesla's tower (Wardenclyffe Tower): 12 meters height prototype finally raised! -

http://english.pravda.ru/business/finance/15-05-2015/130611-china_gold_dollar-0/

China saves up 30,000 tons of gold to topple US dollar from global reign -

http://www.naturalnews.com/050101_California_drought_property_values_real_estate_collapse.html

California property values collapse as water shut-offs begin... wealthy community to go dry in days... real estate implosion now inevitable -

Writing's On The Wall: Texas Pulls $1 Billion In Gold From NY Fed, Makes It "Non-Confiscatable"Well, whaddya know, here's the response from the Fed

And there's more where that's coming from if the Texans stay stuck on stupid.

HAARP Attack: Tropical Storm Bill To Get Stronger Over Texas, Rare Event Coming -

Foresight 2020 - Egon von Greyerz Gold Understanding RisksPublished on Jun 12, 2015Foresight 2020 Catalonia meeting Egon von Greyerz talked about financial markets, taking risks, increasing debt, hyperinflation, the importance of gold and precious metals in an environment of broken markets and how market manipulations are doing most harm to world economies.

During the four day meeting: Foresight 2020 hosted by Michael St.Clair - Egon von Greyerz gave talks and questions and answers about the importance of gold and precious metals in today's unstable financial market conditions.

Rather than expressing 'gloom and doom' for the future .. Egon was very positive in his outlook .. telling people to be optimistic about life and enjoy life. At the same time being aware of risks and educating ourselves about the forces that effect us (observing historical and current patterns of behaviour) is essential to self-preservation.

Michael St.Clair was delighted that Egon accepted the invitation to attend the Foresight 2020 meeting in Catalonia - May 2015, that became more a large meeting of friends from all parts of the World. The moving glass door also adds another dimension!

This is the first talk Egon gave to those gathered for the meeting looking at astrology .. financial markets .. gold and the need to get out of the (broken) system as well as the potential of an emerging new paradigm creating a totally new system that functions in an environment of healthy co-operation.

Egon von Greyerz (EvG) is Founder and Managing Partner of Matterhorn Asset Management AG (MAM) and GoldSwitzerland based in Zurich, Switzerland. He regularly speaks at investment conferences around the world. He also publishes articles on precious metals, the world economy and wealth preservation.http://matterhornassetmanagement.com/ -

Writing's On The Wall: Texas Pulls $1 Billion In Gold From NY Fed, Makes It "Non-Confiscatable" -

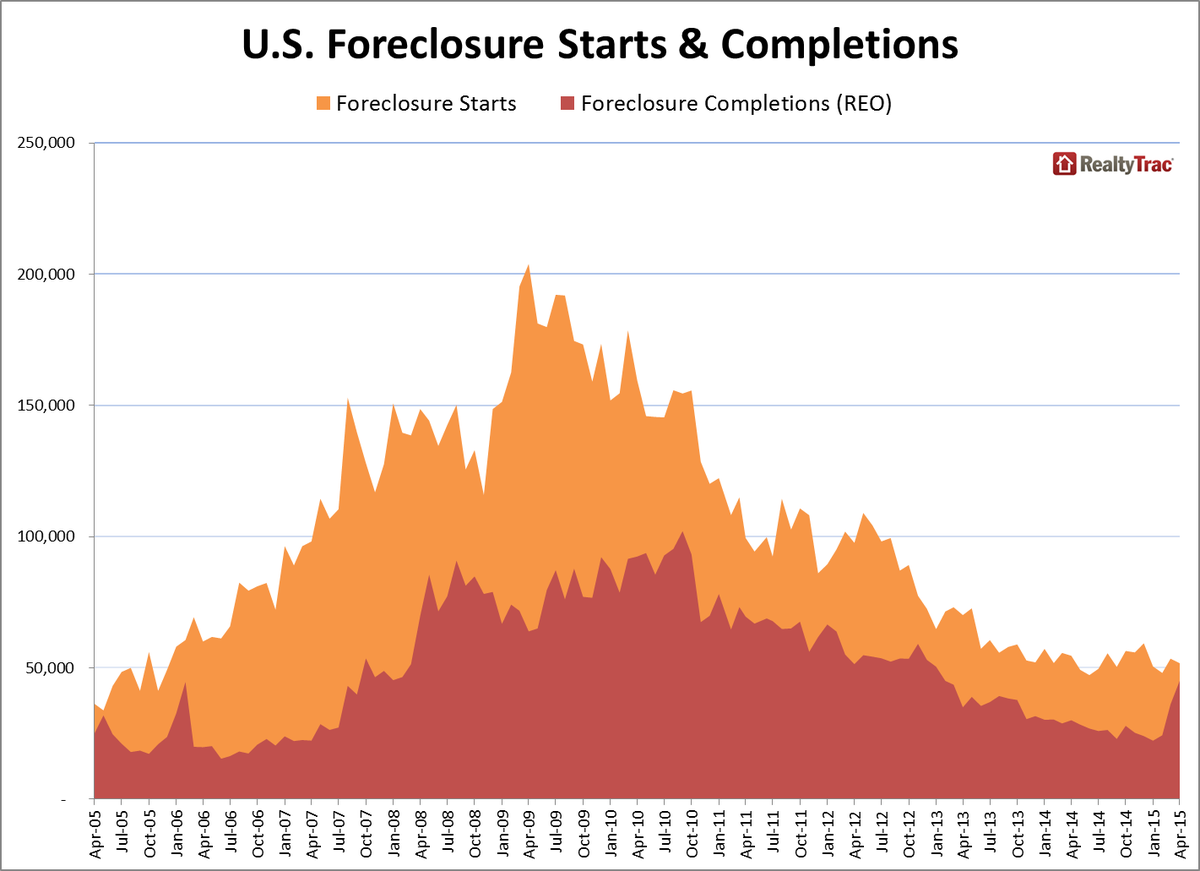

Foreclosure completions have soared 50% from a year ago which means much more inventory is coming to market

-

http://seekingalpha.com/article/3247676-did-comex-just-receive-a-physical-gold-bailout-from-the-feds

Did COMEX Just Receive A Physical Gold Bailout From The Feds?- On June 1, 2015, JPMorgan added almost exactly enough ounces of physical gold to patch the deficiency between supply and delivery demand at COMEX, avoiding widespread dealer default.

- Declassified documents, along with strong circumstantial evidence indicate that it was not JPMorgan, but its most important customer, the US Federal Reserve, that just bailed out COMEX....

-

The Coming Financial Shockwave And One Of The Most Ominous Graphs I’ve Seen In My 50-Year Career

The common theme running through the above points is counterparty risk. The risks of default are without a doubt continuing to worsen, with the consequence that tangible assets are still the best place to be

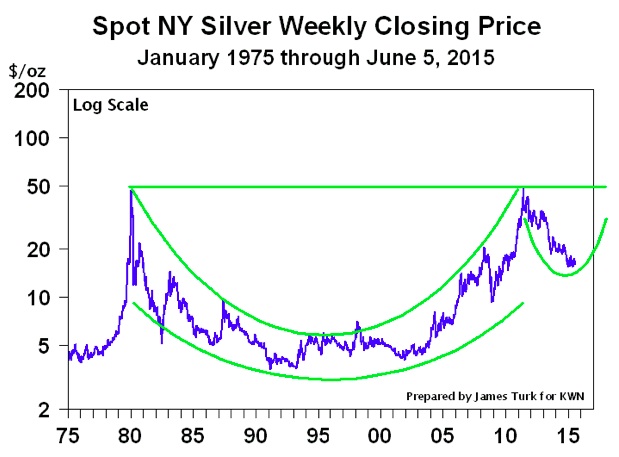

In this regard, this long-term chart is showing a very clear picture of the great prospects for silver, which I think is the most underpriced asset in the world.

..... this “cup and handle” pattern continues to develop.

This pattern being developed makes this chart without a doubt one of the most ominous charts I have ever seen in my 50-year career, and I have seen a lot.

... a long-term chart like this one ..... will help you identify an underpriced asset that is being accumulated by strong hands, and second, it will keep you on the right side of the market because this chart is shouting “higher prices are coming."

-

www.futuresmag.com/2015/06/05/gold-64000-bloomberg’s-‘china-gold-price’

Gold at $64,000 is Bloomberg’s ‘China gold price’

-

Don't know what makes them think the gold is still there to be brought back.....

Kyle Bass Was Right: Texas To Create Own Bullion Depository, Repatriate $1 Billion Of Gold

zerohedge

zerohedge  clif

clif

GOLD

in Gold, FX, Stocks / Diaries & Blogs

Posted

Clif High has been saying that the Chinese gov will revalue gold substantially higher as a consequence of the stock market crash

www.zerohedge.com/news/2015-07-20/case-china’s-missing-gold

The Case Of China’s Missing Gold

while many assume that the only reason China revealed (some of) its latest gold holdings is to further bolster its case for admission into the IMF's Special Drawing Right, the real reason why the PBOC may have resorted to telegraph to the world that it has much more gold is simply to prop up its markets.